FAST

Financial Advisor Support Technologies

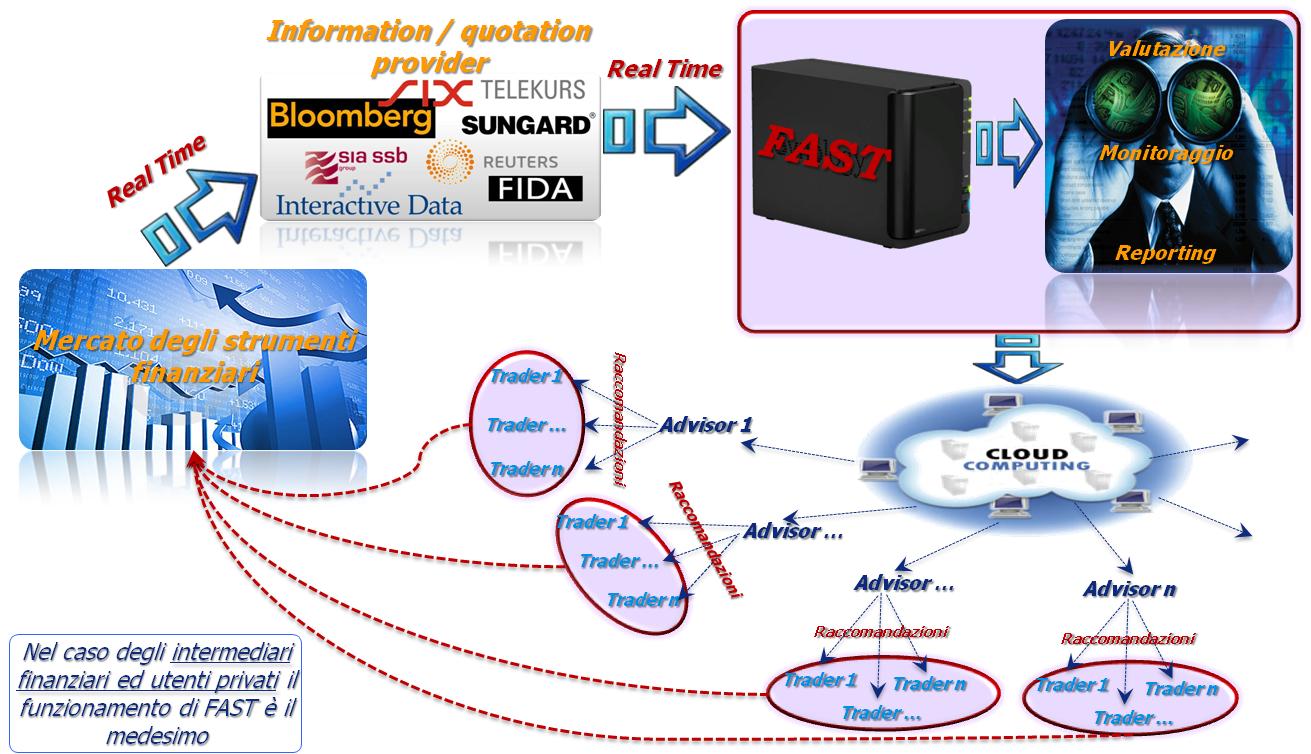

This study aims to identify criteria for the development of a service that can support financial consultancy services in every way: from client profiling and the evaluation of financial instruments, the evaluation of the suitability of an investment given the identified client profile, to monitoring the investment over time and risk management.

Companies, institutional investors and private individuals find it increasingly important to identify sophisticated tools that:

- allow them to evaluate financial instruments in their entirety (on several levels, including actual costs, taxation, cash flow and not just in terms of returns);

- allow them to make a custom evaluation (on the basis of actual data available to the client);

- make the service accessible to small and medium-sized operators as well, currently prevented by the high cost.

Evaluation and analysis algorithms will be examined that take into account not just the official performance of a product but most of all the ‘personal’ situation of the investor: the costs he or she has actually had to pay out for the transaction (which in actual fact can vary from one operator to another), the risk taken on compared to total assets, cash flow requirements and investment timescale. Eventually, the study aims to glean recommendations for a future software prototype which could also be used via the Web and which would allow users the option of checking each investment regularly and monitoring its performance over time, proving to be a valuable decision-making aid.

Start

2011

Type

2.1 - Feasibility studies

Project value

€ 60.000

Call

Project co-financed as part of the Piedmont Regional Innovation poles (ROP ERDF 2007/2013, Axis I, I.1.3 activities - First Call Intermedia 2011 destined to the facilities for technical feasibility studies for industrial research and Experimental Development and Services for Research and Innovation, reserved for individuals to aggregate Innovation Poles)